IN SF 2837 2015-2026 free printable template

Show details

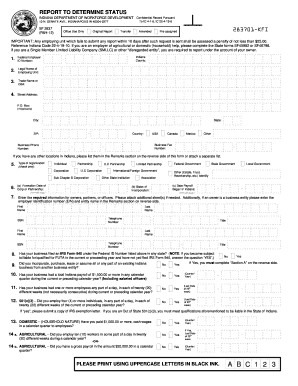

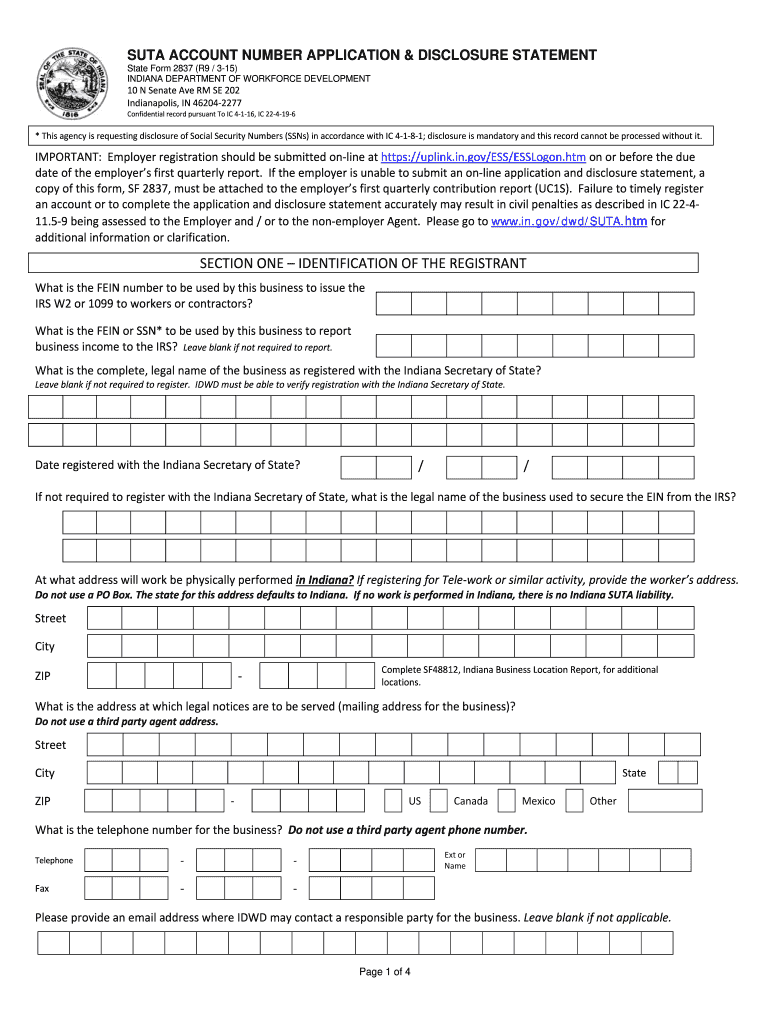

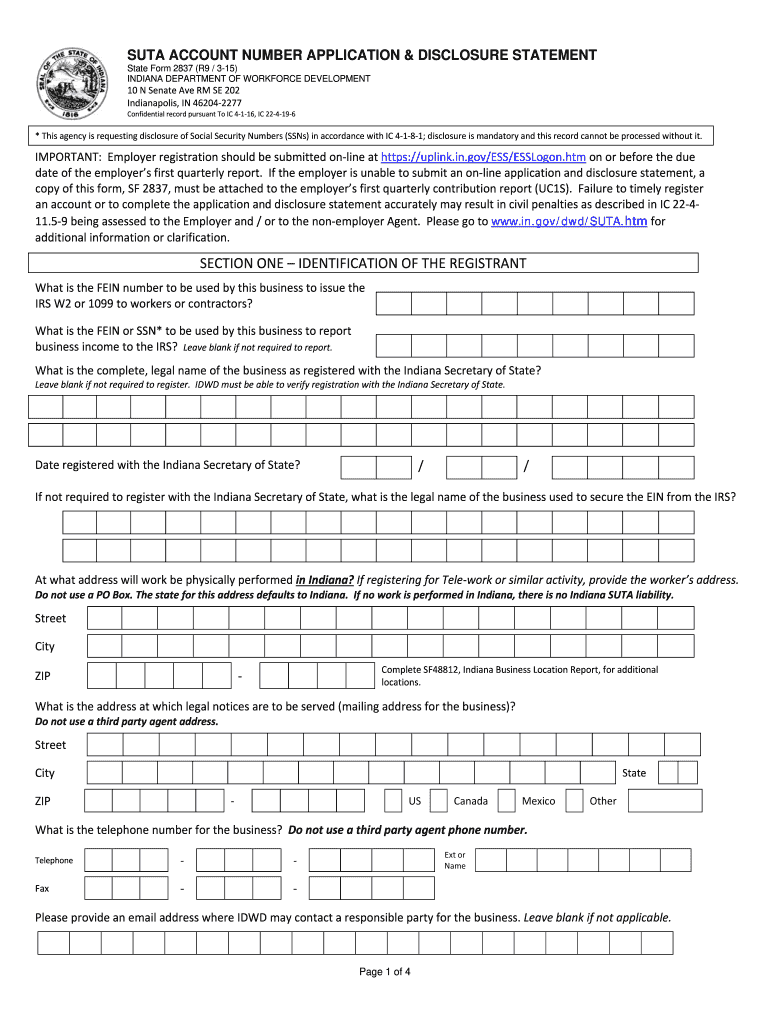

Reset Form SUTA ACCOUNT NUMBER APPLICATION DISCLOSURE STATEMENT State Form 2837 R9 / 3-15 INDIANA DEPARTMENT OF WORKFORCE DEVELOPMENT 10 N Senate Ave RM SE 202 Indianapolis IN 46204 2277 Confidential record pursuant To IC 4 1 16 IC 22 4 19 6 This agency is requesting disclosure of Social Security Numbers SSNs in accordance with IC 4 1 8 1 disclosure is mandatory and this record cannot be processed without it. IMPORTANT Employer registration should be submitted on line at https //uplink....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign indiana suta notice form

Edit your indiana unemployment uplink employer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your indiana unemployment uplink self service form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit indiana unemployment uplink indiana career connect online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit dd form 2837. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN SF 2837 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out suta form

How to fill out IN SF 2837

01

Start by downloading the IN SF 2837 form from the appropriate website.

02

Fill in the personal information section, including your full name, address, and contact details.

03

Provide your Social Security Number and any relevant identification numbers as required.

04

Complete the section regarding your employment status and position.

05

If applicable, document any family member details as required by the form.

06

Review the instructions for additional documentation needed, such as identification or proof of employment.

07

Sign and date the form at the designated area.

08

Submit the completed form as per the guidelines provided, either electronically or via mail.

Who needs IN SF 2837?

01

Individuals applying for certain benefits or services in connection with federal employment.

02

Employees who need to provide information about their dependents for health benefits.

03

New hires within federal agencies requiring enrollment in benefit plans.

Fill

state of indiana unemployment uplink

: Try Risk Free

People Also Ask about divorce papers south africa

How to register with Indiana Department of Workforce Development?

Registration Steps: Combined registration for IN State withholding and IN State unemployment tax. Go to INBiz to complete the online registration. Click register now. Create a username and password for the Department of Workforce Development. Go to Uplink Employer Self Service Website.

What is the Indiana unemployment tax rate for 2023?

Indiana. Unemployment tax rates range from 0.50% to 7.40% in 2023 and through 2025. The wage base holds at $9,500.

How much is Indiana state unemployment tax?

Indiana updated its unemployment insurance employer handbook on Jan. 31 to include tax rates and unemployment-taxable wage base information for 2023. Tax rates for positive-rated employers range from 0.5% to 3.8% for nondelinquent employers and from 2.5% to 5.8% for delinquent employers, ing to the handbook.

Do I have to register with the Department of Workforce Development in Indiana?

If you have employees - even temporary ones - you will also need to register with the Indiana Department of Workforce Development. It oversees employee reporting, new hire reporting, unemployment insurance and wage reporting for the state of Indiana.

What is the Indiana SUTA tax rate for 2023?

SUTA tax rate and wage base 2023 Wage BaseMax (%)Hawaii$56,7006.2Idaho$49,9005.4Illinois$13,2717.625Indiana$9,5009.447 more rows • Feb 7, 2023

What is the federal unemployment tax rate in Indiana?

Indiana updated its unemployment insurance employer handbook on Jan. 31 to include tax rates and unemployment-taxable wage base information for 2023. Tax rates for positive-rated employers range from 0.5% to 3.8% for nondelinquent employers and from 2.5% to 5.8% for delinquent employers, ing to the handbook.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify indiana suta without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including department of workforce development uplink. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I get suta forms?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the indiana unemployment employer self service in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit uplink self service login on an iOS device?

Create, modify, and share IN SF 2837 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is IN SF 2837?

IN SF 2837 is a form used for reporting specific financial information, often related to federal or state compliance.

Who is required to file IN SF 2837?

Entities or individuals engaged in activities that fall under the reporting requirements set forth by the governing body are required to file IN SF 2837.

How to fill out IN SF 2837?

To fill out IN SF 2837, you need to provide the required information accurately, ensuring all fields are completed according to the instructions provided with the form.

What is the purpose of IN SF 2837?

The purpose of IN SF 2837 is to ensure compliance and transparency in financial reporting for regulatory authorities.

What information must be reported on IN SF 2837?

The information that must be reported on IN SF 2837 typically includes financial details such as income, expenses, and any other data relevant to the specific reporting requirements.

Fill out your IN SF 2837 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IN SF 2837 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.